Calculate ltv for heloc

People with an excellent credit score of above 760 will get the best rates. Fields Terms and Definitions.

Home Equity Line Of Credit Heloc Rocket Mortgage

They often work by replacing your existing mortgage taking over as a first mortgage while also working like a checking account.

. Home equity line of credit calculator excel will calculate the payments and show you an amortization schedule for each payment. HELOC Home Equity Loan Qualification. The HELOC repayment is structured in two phases.

While both a HELOC and a second mortgage use your home equity as collateral a second mortgage can offer you access to a higher total borrowing limit at a higher interest. Available equity in the home. Heloc Combo Rates 5240 95 LTV Apply Now.

As mentioned above banks typically allow a max LTV of 70 to 85. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out. For example if the LTV ratio is 75 or lower you could get a lower rate because the loan is seen as less risky to the lender.

PNC only offers a HELOC for home equity with interest rates from 225 to 24 and no minimum draw amount. Pay off more high-interest debt. A home equity line of credit HELOC on the other hand is another type of second mortgage that uses your home as collateral.

HELOC Terms Max LTV. The more your home is. And the loan to value LTV the lender is willing to extend to you.

For example if your current balance is 100000 and your homes market value is 400000. 399 APR Calculate. Rates quoted require a loan origination fee of 100 which.

You can calculate this figure by taking the current market value of. HELOC versus Home Equity Loan. Use this calculator to determine the home equity line of credit amount you may qualify to receive.

Above you could get a home equity line of credit. August 31 202210-Year HELOC Rates Reach A 52. Use our HELOC calculator to find out how much you could borrow with a home equity line of credit.

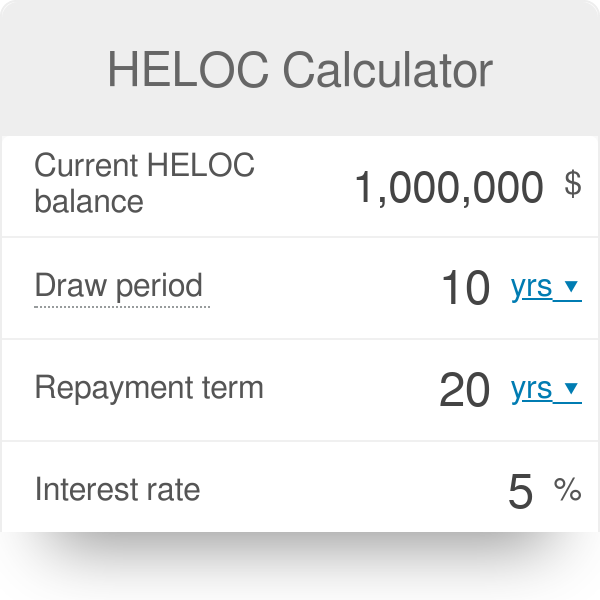

The HELOC calculator is calculated based on your current HELOC balance interest rate interest-only period and the repayment period. The tool will immediately calculate your current loan-to-value ratio. Learn how a HELOC payment is calculated.

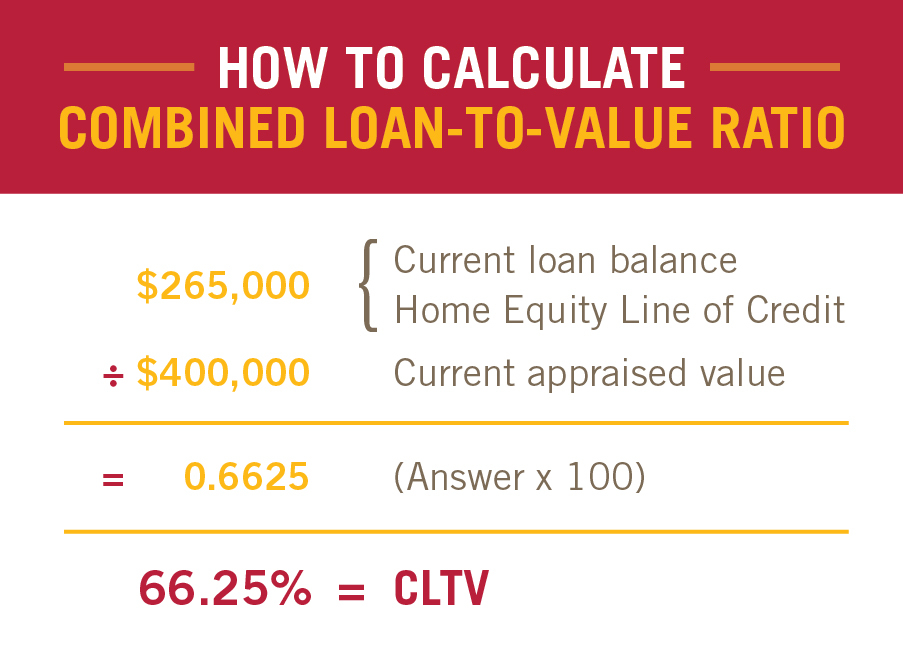

Learn More about Managing Your HELOC. Loan-to-value LTV occupancy and loan purpose so your rate and terms may differ. Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home.

You can compute LTV for first and second mortgages. If you own at least 20 of your home an LTV of 80 or less youll probably qualify for a home equity loan depending on. September 6 202210-Year HELOC Rates Hit A New High By Andrea Riquier Forbes Advisor Staff Average HELOC Rates.

Results are estimated based on a Smart Refinance loan amount of. Then use NextAdvisors loan calculator to calculate the total cost of borrowing and monthly payment to accurately compare lenders. Your credit line caps at 899 of your homes equity depending on the state where you live and you can draw on your account for 10 years paying interest-only payments then add principal to repay the loan in full over the next 20 years.

To get a home equity loan or HELOC with bad credit will require a debt-to-income ratio in the lower 40s or less a credit score of 620 or more and a home worth at least 10 to 20 more than what. It also helps your lender determine whether or not youll have to pay for private mortgage insurance PMI. This section of the page contains a carousel that visually displays various slides one at a time.

The three primary things banks look at when assessing qualification for a home equity loan are. You receive the funds on. A Home Equity Loan is more like a traditional.

HELOC Payment Calculator excel to calculate the monthly payments for your HELOC loan. Home equity loans vs. For screen reader users pausing the slider will allow the slides to be announced simply when you.

Your home appraisal can also affect your home loan during a refinance. Or LTV and credit score before making a decision on your HELOC application. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home.

You may apply for a Smart Refinance loan up to. Just to be clear a Home Equity Line of Credit is not the same thing as a Home Equity Loan. The line of credit is based on a percentage of the value of your home which is also known as loan-to-value LTV.

The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. A first lien HELOC is a line of credit and mortgage in one. View More Homeowner Resources.

Additionally you may be limited to borrowing 85 of your homes value minus your outstanding loan balance though some lenders offer high-LTV home equity loans. HELOC Payments How are HELOC repayments structured. Get answers to questions about your HELOC including how we calculate your interest rate.

To avoid PMI your LTV typically needs to be 80 or less but PMI applies only to first liens so if your home equity line of credit is a second lien against your house you shouldnt have to worry about paying PMI. Find out how to calculate the equity in your home your home equity percentage and the loan-to-value LTV based on the current market price. Those with good credit.

Your home value Your home value. 799 APR Calculate. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance.

The draw period is. What is the difference between getting a HELOC and a second mortgage. Make more home renovations.

A HELOC on the other hand gives you the flexibility to borrow and pay off the credit whenever you want. All loans subject to credit approval. All with the Lower Home Equity Line of Credit.

Click the Calculate HELOC Payment button. It can play a big role in the interest rate that you get since the appraisal helps determine your LTV loan-to-value ratio. Calculate the equity available in your home using this loan-to-value ratio calculator.

To calculate your homes equity divide your current mortgage balance by your homes market value. For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home. Up to 95 LTV with a HELOC Combo Calculate your available funds.

Loan-To-Value Ratio - LTV Ratio. Here Are Todays HELOC Rates.

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Heloc Calculator To Calculate Maximum Home Equity Line Of Credit

Home Equity Line Of Credit Heloc Macu

Second Mortgage Calculator Qualification Payment Wowa Ca

Heloc Calculator

Ltv Calculator For Mortgage Pmi Refinancing Mortgages Home Equity Loan Qualification

Home Equity Line Of Credit Qualification Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

How To Calculate Your Loan To Value Ltv Ratio

How To Calculate Equity In Your Home Nextadvisor With Time

How To Calculate Your Home Equity Finder Com

How To Calculate Your Loan To Value Ratio Finder Com

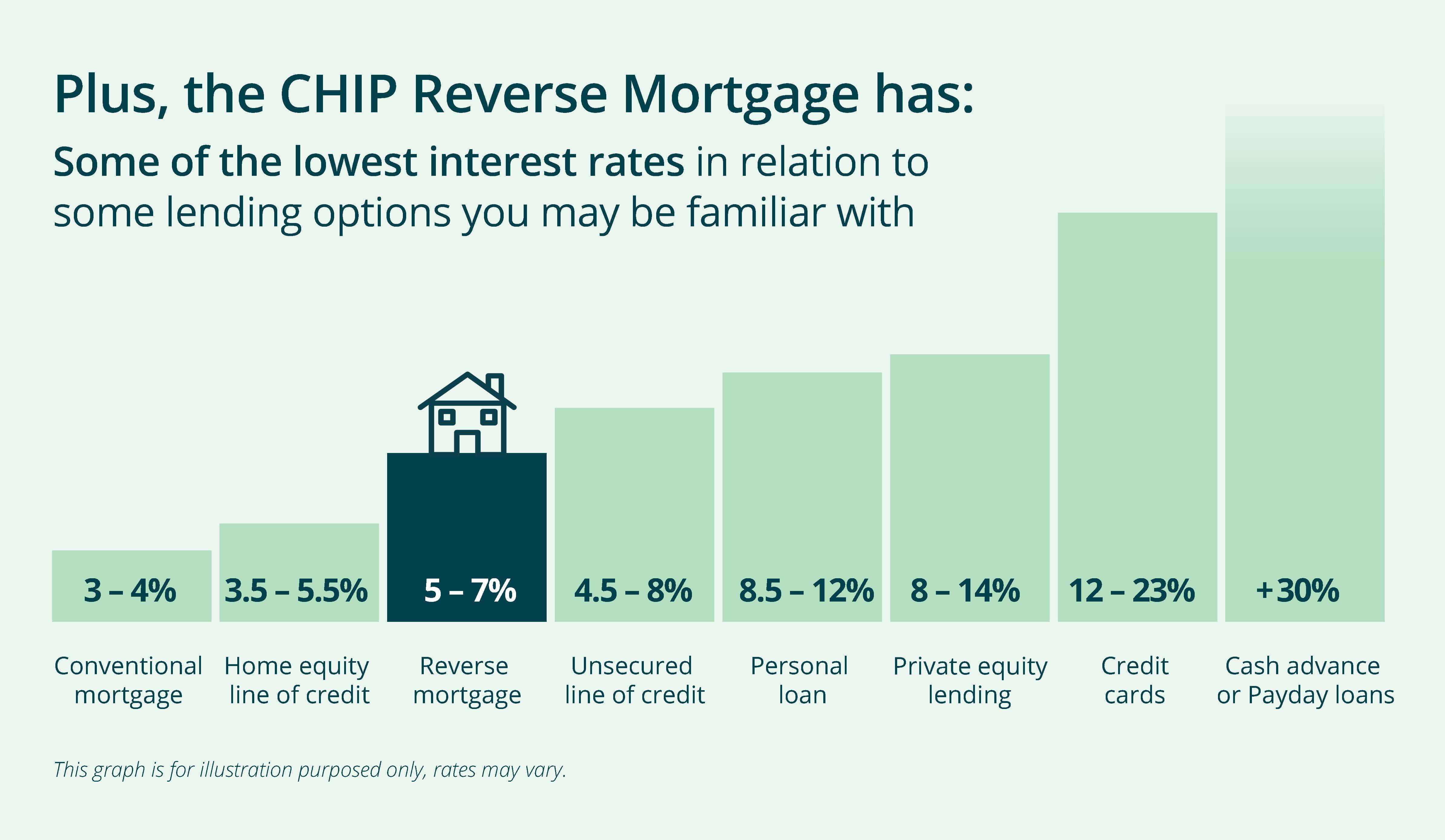

Heloc Rates In Canada Homeequity Bank

Loan To Value Ltv Calculator Find Your Ltv Ratio Wowa Ca

Na Zgomvhygwqm

Home Equity Line Of Credit Heloc Rocket Mortgage

Loan To Value Ratio What Is It And How To Calculate It Mortgage Broker Store