37+ mortgage interest itemized deduction

Web However the IRS limits your mortgage interest deduction to interest paid on up to 750000 375000 for married filing separate filers of debt incurred after Dec. Fewer taxpayers itemized after TCJA largely because state and local tax deductions were capped at 10000 while the standard deduction doubled and was indexed for inflation.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

. Web If you itemize complete the Iowa Schedule A check the itemized box on line 37 and enter your total itemized deduction. Ad Dont Leave Money On The Table with HR Block. Homeowners who bought houses before.

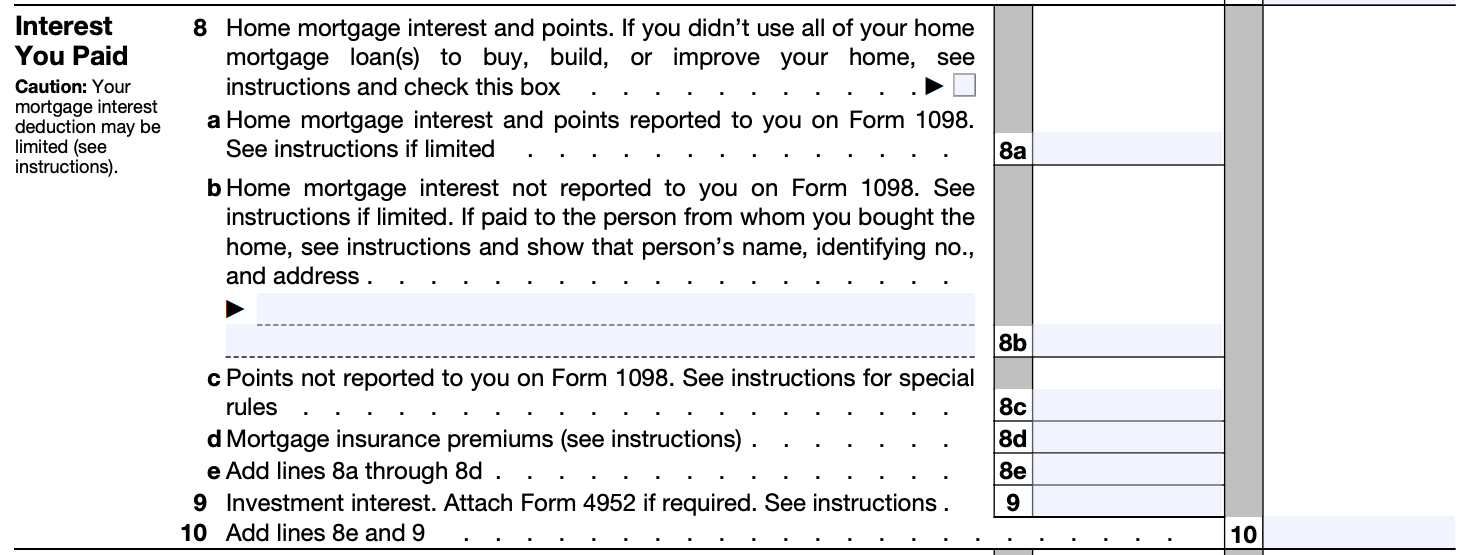

Interest Paid on qualified student loans is. Up to 500000 of debt. Web For federal purposes the itemized deduction rules for home mortgage and home equity interest you paid in 2021 have changed from what was allowed as a.

The IRS allows individuals to. Web Filing separately. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Discover How HR Block Makes It Easier to File Your Way. Web The following is a list of expenses that qualify as itemized deductions and listed on IRS Form 1040 Schedule A.

Web In the TurboTax program when you enter itemized deductions such as mortgage interest property taxes medical expenses charitable contributions all of. Ad Access Tax Forms. Web Why most people opt for standard deductions.

Get Your Max Refund Guaranteed. Business interest is not deductible as an itemized deduction even if it is for employee business expenses. Also you can deduct the points.

By using the standard deduction and not itemizing taxpayers werent getting a tax benefit for things like. Discover Helpful Information And Resources On Taxes From AARP. The bottom of Form 1040 page 2 collects required signaturesfrom you your spouse and your tax pro if you used oneand lets you name someone who can discuss your.

Web Business interest is deductible against business income. Get Your Max Refund Guaranteed. Web Your itemized deductions might look something like this.

Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Web After totaling their qualified itemized deductions including the mortgage interest they arrive at 32750 that can be deducted.

Interest on a car loan where an employee uses the vehicle for business is nondeductible as personal interest. Since this is larger than the. File Online or In-Person Today.

Include your Iowa Schedule A with your return. Up until six years ago you could take out a home equity loan use it for almost anything and fully deduct the annual interest. Web 20 hours agoItemized deductions are based on specific expenses such as charitable contributions mortgage interest state and local taxes up to 10000 per year and.

Ad Dont Leave Money On The Table with HR Block. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Complete Edit or Print Tax Forms Instantly.

Discover How HR Block Makes It Easier to File Your Way. File Online or In-Person Today.

Is Mortgage Interest Tax Deductible In Canada Nesto Ca

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Home Mortgage Loan Interest Payments Points Deduction

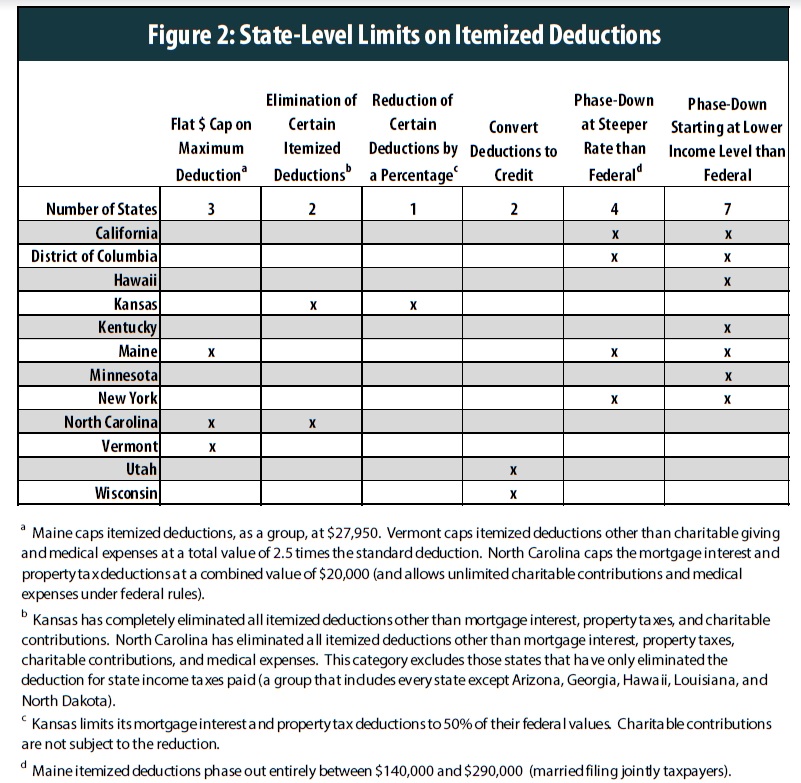

State Treatment Of Itemized Deductions Itep

:max_bytes(150000):strip_icc()/4592-f64c21a16a3847538c094ee48dee34fe.jpg)

Form 4952 Investment Interest Expense Deduction Definition

Race And Housing Series Mortgage Interest Deduction

Maximum Mortgage Tax Deduction Benefit Depends On Income

Investment Expenses What S Tax Deductible Charles Schwab

Mortgage Interest Deduction Bankrate

Can I Include Interest Payments As An Itemized Deduction Universal Cpa Review

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

Your Guide To Tax Deductions In Germany For 2022 N26

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service